Everything You Need to Know About Security Bonds for Foreign Workers in Singapore

Hiring foreign workers is an integral part of running many businesses in Singapore. However, ensuring compliance with the Ministry of Manpower (MOM) regulations can feel overwhelming. This is where security bonds come into play – a vital safeguard that protects employers from potential liabilities while ensuring legal compliance.

In this blog, we’ll walk you through everything you need to know about security bonds in Singapore, from their purpose and coverage to practical tips for obtaining the right bond for your business needs. Let’s get started.

What is a Security Bond?

A security bond is a legally binding agreement between employers and the Ministry of Manpower (MOM) in Singapore. It acts as a financial guarantee to ensure that employers comply with MOM regulations when hiring foreign workers. Essentially, the bond safeguards both employers and workers by outlining the responsibilities and obligations of the employer.

Why Security Bonds Matter

Security bonds serve as a layer of financial protection for businesses hiring foreign workers. Employers can be penalized if they fail to meet MOM’s requirements, such as paying salaries on time, providing proper accommodations, or repatriating workers when necessary. The security bond ensures employers remain compliant, reducing risks associated with hiring foreign labor.

Key Features of a Security Bond:

- Guarantees compliance with MOM regulations.

- Provides financial protection for employers against potential penalties.

- Ensures proper treatment and rights of foreign workers.

Who Needs a Security Bond?

Security bonds are essential for employers who hire foreign workers in Singapore, as mandated by the Ministry of Manpower (MOM). Whether you are hiring domestic helpers, construction workers, or employees in other sectors, a security bond ensures you meet all legal requirements and protects your business from potential liabilities.

Employment Scenarios Requiring Security Bonds

- Foreign Domestic Workers (FDWs):

- Employers hiring foreign domestic helpers must secure a bond to ensure compliance with MOM regulations, including proper care and repatriation.

- Construction and Marine Industry Workers:

- Businesses in sectors like construction and marine hire foreign labor frequently. Security bonds are a prerequisite for their employment permits.

- Other Industries Employing Foreign Workers:

- Retail, hospitality, and manufacturing businesses employing foreign staff need security bonds to ensure adherence to employment regulations.

Why It’s Important

Failure to obtain a security bond can lead to legal penalties, fines, or the suspension of your ability to employ foreign workers. By securing this bond, you demonstrate compliance, accountability, and commitment to fair employment practices.

What Does a Security Bond Cover?

A security bond is designed to protect employers by covering key costs and responsibilities required by the Ministry of Manpower (MOM) regulations. This ensures you remain compliant while safeguarding against unexpected expenses.

Coverage and Exclusions

| Covered | Not Covered |

|---|---|

| Repatriation Costs: Covers expenses for sending the foreign worker back to their home country if required by MOM. | Medical Expenses: These are covered separately under insurance policies, not the security bond. |

| Compliance Penalties: Protects employers from fines due to non-compliance with MOM regulations, such as insufficient living conditions. | Workers Hired Without Valid Permits: Workers without proper documentation are not covered. |

| Bond Amounts: Ensures the required bond coverage amount as mandated by MOM. | Deliberate Non-Compliance: Penalties from illegal actions or breaches of regulations are excluded. |

By understanding the inclusions and exclusions, employers can effectively manage their workforce while staying aligned with MOM’s guidelines.

Why Do You Need a Security Bond in Singapore?

A security bond is more than just a legal requirement; it is a critical safeguard for employers managing foreign workers. MOM mandates the bond as part of its strict compliance policies, ensuring that employers adhere to fair employment practices and responsibilities.

Key Reasons to Have a Security Bond

- Compliance with MOM Regulations As an employer, you are legally obligated to provide a security bond to ensure adherence to employment laws and prevent penalties.

- Financial Protection The bond helps cover costs arising from non-compliance or worker repatriation, ensuring you are not financially burdened by unexpected events.

- Workforce Assurance Having a security bond in place demonstrates your commitment to responsible hiring practices, which fosters a positive relationship between employers and workers.

By securing a bond, you protect not only your business but also ensure ethical practices that benefit your workforce and reputation.

How to Apply for a Security Bond in Singapore

Navigating the process of obtaining a security bond may seem daunting, but with the right steps, it can be straightforward. Here’s how you can secure a bond seamlessly:

Step 1: Assess Your Requirements

Determine the type of security bond you need. For example, hiring foreign domestic workers (FDWs) versus other foreign workers might have different bond amounts and conditions.

Step 2: Choose a Trusted Provider

Partner with a licensed insurance company that offers MOM-compliant security bonds. Look for providers with experience in workforce-related insurance solutions.

Step 3: Submit the Necessary Documentation

Prepare essential documents, including:

- Employment details of the worker.

- Employer information.

- MOM application forms (if required).

Step 4: Pay the Bond Amount

Pay the security bond amount as per MOM’s guidelines. Your insurer or agent will guide you through the payment process.

Step 5: Receive Your Bond Certificate

Once issued, the bond certificate will be submitted to MOM by your provider. Ensure all conditions outlined in the bond agreement are fulfilled to avoid forfeiture.

Pro Tip:

Consulting with an experienced provider, like Ad Maiora, can simplify the process and ensure full compliance, saving you time and effort.

How much does a Security Bond Cost?

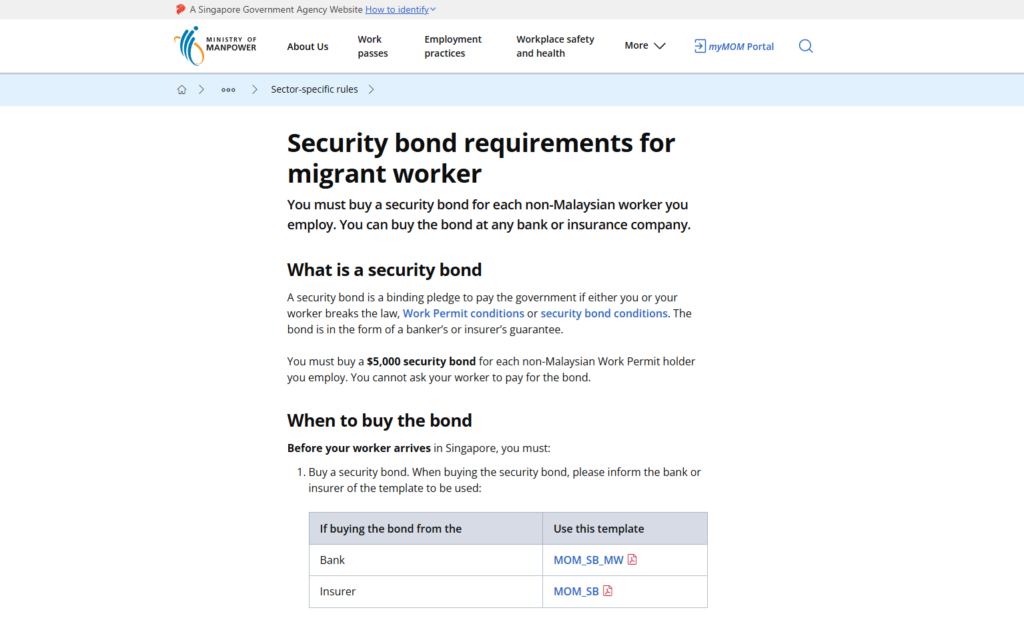

The cost of a security bond in Singapore depends on several factors, including the type of foreign worker employed and the specific requirements set by the Ministry of Manpower (MOM).

Standard Costs for Security Bonds

- For most foreign domestic workers (FDWs), MOM requires a bond of $5,000.

- For other categories of foreign workers, the required bond amount can vary, depending on the industry and the nature of the job. Employers should consult MOM guidelines or their insurer for precise details.

Factors That Influence Security Bond Costs

- Type of Worker: FDWs typically require a fixed bond amount, while construction or marine workers may have varying requirements based on their roles.

- Insurer’s Policy: Different insurers may offer packages bundling security bonds with additional coverage like medical or repatriation insurance. The cost of these packages can differ.

- Employer Risk Profile: Insurers might consider the employer’s history, such as past compliance with MOM regulations, which could affect the premium for the bond.

Get Security Bond Insurance in Singapore

A security bond is not just a legal obligation – it’s a crucial safeguard for both employers and their foreign workers in Singapore. By ensuring compliance with MOM requirements, a well-structured bond offers peace of mind, protects against unexpected liabilities, and demonstrates your commitment to responsible workforce management.

At Ad Maiora, we specialize in providing seamless security bond solutions tailored to your unique needs. With us, you can focus on managing your workforce while we handle the complexities of compliance. If you’re also looking to understand more about employee protection, don’t miss our detailed guide on WICA insurance in Singapore.

Take the Next Step: Learn more about our Security Bond solutions or Get a Quote today. Secure your workforce, secure your peace of mind.

Leave a Reply