A Complete Guide to Cyber Insurance in Singapore

In today’s digital age, businesses of all sizes are vulnerable to cyberattacks. From phishing scams to large-scale ransomware breaches, the impact of a cyber incident can be devastating – causing significant financial losses and reputational damage. Cyber insurance plays a crucial role in safeguarding your business against these unexpected threats by providing financial protection and support when you need it most.

In this comprehensive guide, we’ll cover everything you need to know about cyber insurance in Singapore – what it covers, why it’s essential, and how to choose the right policy for your business.

What is Cyber Insurance?

Cyber insurance, also known as cyber liability insurance, is a policy designed to protect businesses against the financial impact of cyber threats such as data breaches, malware, and ransomware attacks. It provides coverage for various cyber-related risks, including costs related to business disruptions, data recovery, legal fees, and regulatory fines.

Key Purpose of Cyber Insurance:

- Risk Mitigation: Offers financial assistance to recover from cyberattacks and minimize operational downtime.

- Legal Protection: Covers legal costs if your company is held liable for a breach of customer data.

- Customer Trust: Demonstrates that your business takes cybersecurity seriously, fostering trust among customers and stakeholders.

Why is Cyber Insurance Important for Businesses?

In today’s digital era, no business is immune to cyber threats. Whether you are a small business or a large corporation, cyberattacks can disrupt operations, damage your reputation, and lead to significant financial losses. Cyber insurance helps mitigate these risks by providing financial protection and resources for recovery.

1. Financial Protection Against Cyberattacks

Cyber incidents can cost businesses millions in recovery expenses. From data restoration to compensating affected clients, the costs can quickly escalate.

2. Legal and Regulatory Compliance

Many jurisdictions require businesses to notify customers and regulators in the event of a data breach. Cyber insurance covers legal expenses, regulatory fines, and customer notifications.

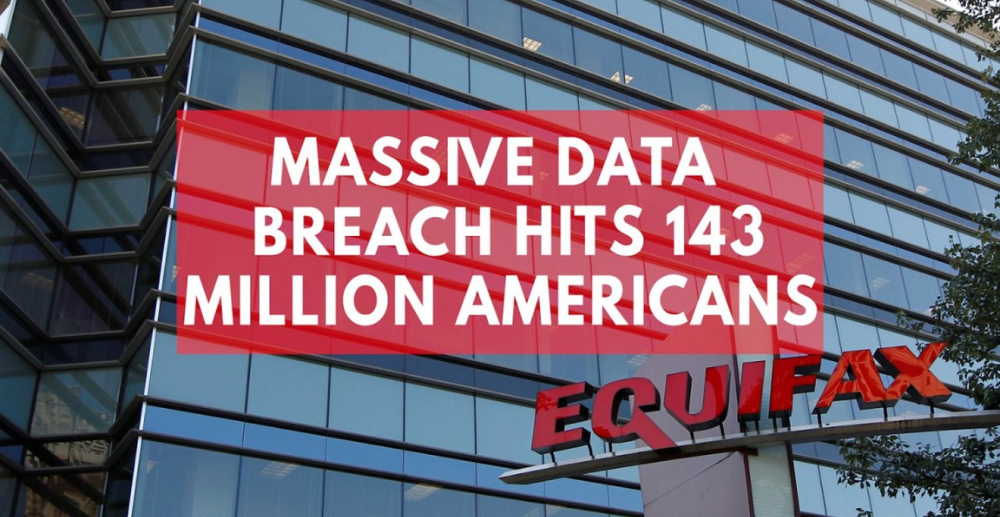

One notable example is the Equifax data breach of 2017, where hackers gained access to the personal data of 143 million people, including Social Security numbers and credit card details. This breach cost Equifax over $1.4 billion USD in settlements, legal fees, and cybersecurity improvements.

This example highlights how critical it is to have cyber insurance coverage that mitigates such devastating financial impacts, ensuring your business can recover without crippling losses.

3. Enhanced Incident Response

Most cyber insurance policies come with access to expert incident response teams who can help contain the breach and minimize the impact.

Here’s a quick comparison to show the importance of cyber insurance:

| With Cyber Insurance | Without Cyber Insurance |

|---|---|

| Covers data recovery, legal costs, and public relations | Business pays out-of-pocket for all damages |

| Provides a dedicated response team for crisis management | Requires internal resources, which may not be equipped to handle the breach |

| Maintains customer trust through rapid response | Risk of reputational damage due to delayed response |

What Does Cyber Insurance Cover?

Cyber insurance offers a range of coverages designed to help businesses recover from various types of cyber incidents. These coverages can be customized based on the specific needs of the business. Below are some of the key areas typically covered by cyber insurance:

1. Data Breach Response Costs

- Covers the cost of notifying affected customers.

- Covers legal consultation and credit monitoring for impacted individuals.

2. Business Interruption Losses

- Compensates for lost income if your operations are disrupted due to a cyberattack.

- Covers expenses for temporary workarounds to keep the business running.

3. Cyber Extortion and Ransomware Payments

- Covers payments made to hackers to regain access to critical systems or data.

- Includes negotiation assistance and technical support.

4. Legal Defense and Settlements

- Covers the cost of defending the business against lawsuits related to cyber incidents.

- Includes settlements or compensation required to resolve disputes.

5. Public Relations and Crisis Management

- Provides support for communication strategies to maintain customer trust.

- Covers the cost of hiring PR experts to manage public perception post-incident.

What is Not Covered by Cyber Insurance?

While cyber insurance offers essential protection, it’s equally important to understand its limitations. Policies typically exclude specific situations to avoid covering preventable risks or illegal activities. Below are some common exclusions:

1. Pre-Existing Vulnerabilities

- Incidents arising from known but unresolved system weaknesses are typically not covered.

- Example: If your company failed to update critical software after a vulnerability was publicly disclosed, any attack exploiting that weakness may not be covered.

2. Intentional Acts by Employees

- Cyber insurance does not cover damages caused by intentional, malicious actions from internal staff.

- Example: A disgruntled employee deliberately deletes sensitive files as an act of sabotage.

3. Regulatory Fines and Penalties

- Some policies exclude government-imposed fines for non-compliance with regulations.

- Example: If your business is fined for breaching GDPR or PDPA due to poor data protection practices, the penalty may not be covered.

4. Outdated Security Measures

- If your business does not meet the minimum security standards specified in the policy, claims may be denied.

- Example: Failure to implement multi-factor authentication, as required by the insurer, can result in claim rejection.

By being aware of these exclusions, businesses can take additional steps to strengthen their cybersecurity posture and choose the right policy that matches their operational needs.

Choosing the Right Cyber Insurance Policy

Selecting the best cyber insurance policy for your business can feel overwhelming, but it doesn’t have to be. Here’s a step-by-step guide to help you evaluate your needs and make an informed decision.

Step 1: Assess Your Cybersecurity Risks

Understand the unique cyber threats your business may face:

- Do you store sensitive customer data?

- Are your employees working remotely, increasing potential entry points for attacks?

Knowing your vulnerabilities will help you prioritize the type of coverage you need.

Step 2: Determine Your Coverage Needs

Review your existing security measures and business operations:

- Do you require coverage for ransomware payments, business interruptions, or legal expenses?

- How much coverage do you need to feel secure against potential losses?

This step ensures that your coverage limits align with your business’s exposure.

Step 3: Compare Policy Features

Look at key coverage areas, such as:

- Data breach response and public relations support

- Cyber extortion and ransom payments

- Defense costs for legal claims and regulatory investigations

Reviewing these features will help you understand the value provided by different insurers.

Step 4: Check for Exclusions

Understand what’s not covered by the policy and whether you can add optional coverage:

- Will the policy cover fines from regulatory bodies?

- Does it require specific security practices, such as regular software updates or employee training?

Step 5: Review and Ask for Customization Options

Consider policies that can be tailored to your business needs:

- Can the policy be adjusted to cover emerging risks like phishing scams or DDoS attacks?

- Does the insurer offer add-ons like crisis management support?

Key Takeaway

A good cyber insurance policy should complement your existing security measures rather than replace them. Partnering with the right insurer ensures you’re covered for both known and unforeseen cyber threats.

Get Comprehensive Cyber Insurance in Singapore

In today’s digital world, cyber security insurance is no longer optional – it’s a critical component of any robust risk management strategy. A well-chosen policy doesn’t just cover the financial impact of cyberattacks but also offers essential support during crises, such as data breaches or ransomware incidents.

At Ad Maiora, we understand the complexities of cyber threats and provide tailored insurance solutions to meet your business’s unique needs. Our comprehensive policies cover legal costs, business interruptions, and more, giving you peace of mind in the face of evolving cyber risks. If you’re unsure, just ask! Asking is always free 😁

👉 Read our latest insights on how WICA insurance safeguards your workforce or contact us today for a personalized cyber insurance quote. Protect your business, protect your future.

Leave a Reply